- Non-ficton

- Non-ficton

- Contemporary Fiction

- Contemporary Fiction

- Children

- Children

- Comics & Graphic Novels

- Comics & Graphic Novels

- Non-Fiction

- Non-Fiction

- Fiction

- Fiction

At a time when the world is navigating ways to address key challenges, from climate change to financial inclusion and food security, we are also witnessing a significant change in the investment landscape.

H.I.T. Investing shares cases of eight leading impact investors-AC Ventures, Quona, Capria Ventures, Verdane, Apis, Future Planet Capital, SDCL, Lok Capital-and the results achieved by them globally. These investors have aptly leveraged the disruption power of technology to enhance their reach and impact. With in-depth case studies, each chapter covers the strategy and performance of the investor as well as their motivation behind choosing their area of impact.

A must-read for anyone seeking to understand and enter the thriving world of impact investing!

About the Author

Mahesh Joshi has more than eighteen years of experience in private equity, including eight years in impact investing. As the head of Asia Private Equity at BlueOrchard, he focuses on investments in insurance and financial services that drive climate adaptation and resilience across South and South-east Asia. BlueOrchard is a leading global impact investment manager

and member of the Schroders Group, UK.

Prior to BlueOrchard, Mahesh was a director at LeapFrog Investments and focused on investing in companies that improve access and affordability of healthcare products and services across emerging markets in Asia. He previously spent ten years in private equity in India across IDFC Private Equity (now Investcorp) and Darby (private equity arm of Franklin Templeton). He holds an MBA from IIM Calcutta and a bachelor’s in computer science engineering from JNTU, Hyderabad.

- Home

- Business and Management

- H I T Investing Strong Returns Through High-impact Investing Leveraging Technology

H I T Investing Strong Returns Through High-impact Investing Leveraging Technology

SIZE GUIDE

- ISBN: 9780143472056

- Author: Mahesh Joshi

- Publisher: Penguin Business

- Pages: 240

- Format: Hardback

Book Description

At a time when the world is navigating ways to address key challenges, from climate change to financial inclusion and food security, we are also witnessing a significant change in the investment landscape.

H.I.T. Investing shares cases of eight leading impact investors-AC Ventures, Quona, Capria Ventures, Verdane, Apis, Future Planet Capital, SDCL, Lok Capital-and the results achieved by them globally. These investors have aptly leveraged the disruption power of technology to enhance their reach and impact. With in-depth case studies, each chapter covers the strategy and performance of the investor as well as their motivation behind choosing their area of impact.

A must-read for anyone seeking to understand and enter the thriving world of impact investing!

About the Author

Mahesh Joshi has more than eighteen years of experience in private equity, including eight years in impact investing. As the head of Asia Private Equity at BlueOrchard, he focuses on investments in insurance and financial services that drive climate adaptation and resilience across South and South-east Asia. BlueOrchard is a leading global impact investment manager

and member of the Schroders Group, UK.

Prior to BlueOrchard, Mahesh was a director at LeapFrog Investments and focused on investing in companies that improve access and affordability of healthcare products and services across emerging markets in Asia. He previously spent ten years in private equity in India across IDFC Private Equity (now Investcorp) and Darby (private equity arm of Franklin Templeton). He holds an MBA from IIM Calcutta and a bachelor’s in computer science engineering from JNTU, Hyderabad.

User reviews

NEWSLETTER

Subscribe to get Email Updates!

Thanks for subscribing.

Your response has been recorded.

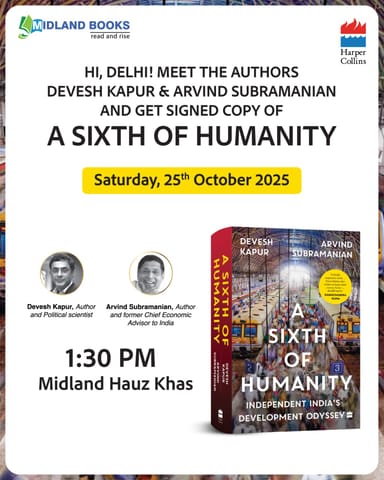

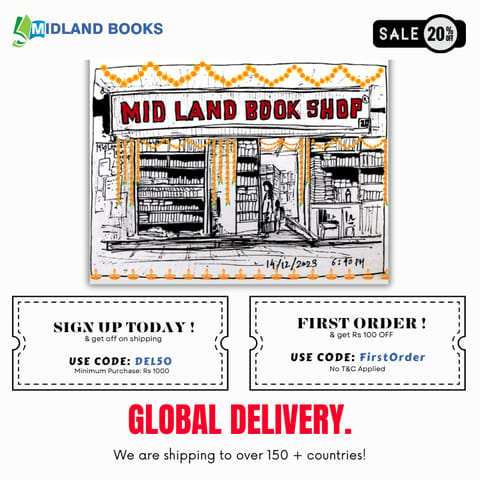

India's Iconic & Independent Book Store offering a vast selection of books across a variety of genres Since 1978.

"We Believe In The Power of Books" Our mission is to make books accessible to everyone, and to cultivate a culture of reading and learning. We strive to provide a wide range of books, from classic literature, sci-fi and fantasy, to graphic novels, biographies and self-help books, so that everyone can find something to read.

Whether you’re looking for your next great read, a gift for someone special, or just browsing, Midland is here to make your book-buying experience easy and enjoyable.

We are shipping pan India and across the world.

For Bulk Order / Corporate Gifting

+91 9818282497 |

+91 9818282497 |  [email protected]

[email protected]

Click To Know More

INFORMATION

QUICK LINKS

ADDRESS

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi