- Non-ficton

- Non-ficton

- Contemporary Fiction

- Contemporary Fiction

- Children

- Children

- Comics & Graphic Novels

- Comics & Graphic Novels

- Non-Fiction

- Non-Fiction

- Fiction

- Fiction

Review

He is so good everyone else may as well pack up ? Evening Standard

No one writes with more narrative panache about money and finance than Mr. Lewis -- Michiko Kakutani ? New York Times

Probably the single best piece of financial journalism ever written ? Reuters

Hugely entertaining ? Economist

Terrifying and superbly told ? Daily Telegraph

Genius ? Sunday Times

Compelling and horrifying -- GQ

A more than worthy successor to Liar's Poker ... if you want to know about the origins of the credit crunch, and the extraordinary cast of misfits, visionaries and chancers who made money from the crash, there's no more readable account ? Daily Telegraph

A triumph ... riveting ... a genuine page-turner ? Times

About the Author

Michael Lewis, who established success from his debut Liar’s poker, has also authored other books such as Boomerang and Moneyball, which was later made into a Hollywood movie starring Brad Pitt.

- Home

- Business and Management

- The Big Short

The Big Short

SIZE GUIDE

- ISBN: 9780141043531

- Author: Michael Lewsi

- Publisher: PENGUIN UK

- Pages: 288

- Format: Paperback

Book Description

Review

He is so good everyone else may as well pack up ? Evening Standard

No one writes with more narrative panache about money and finance than Mr. Lewis -- Michiko Kakutani ? New York Times

Probably the single best piece of financial journalism ever written ? Reuters

Hugely entertaining ? Economist

Terrifying and superbly told ? Daily Telegraph

Genius ? Sunday Times

Compelling and horrifying -- GQ

A more than worthy successor to Liar's Poker ... if you want to know about the origins of the credit crunch, and the extraordinary cast of misfits, visionaries and chancers who made money from the crash, there's no more readable account ? Daily Telegraph

A triumph ... riveting ... a genuine page-turner ? Times

About the Author

Michael Lewis, who established success from his debut Liar’s poker, has also authored other books such as Boomerang and Moneyball, which was later made into a Hollywood movie starring Brad Pitt.

User reviews

NEWSLETTER

Subscribe to get Email Updates!

Thanks for subscribing.

Your response has been recorded.

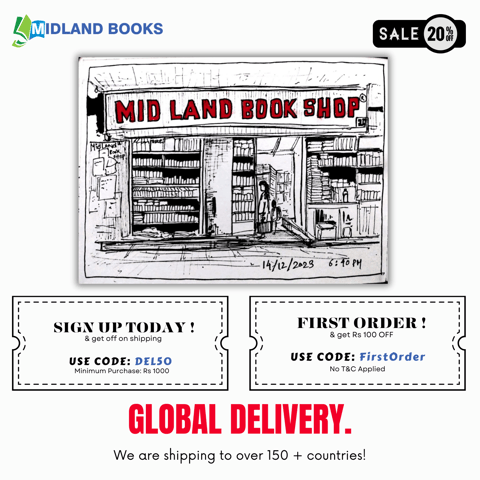

India's Iconic & Independent Book Store offering a vast selection of books across a variety of genres Since 1978.

"We Believe In The Power of Books" Our mission is to make books accessible to everyone, and to cultivate a culture of reading and learning. We strive to provide a wide range of books, from classic literature, sci-fi and fantasy, to graphic novels, biographies and self-help books, so that everyone can find something to read.

Whether you’re looking for your next great read, a gift for someone special, or just browsing, Midland is here to make your book-buying experience easy and enjoyable.

We are shipping pan India and across the world.

For Bulk Order / Corporate Gifting

+91 9818282497 |

+91 9818282497 |  [email protected]

[email protected]

Click To Know More

INFORMATION

QUICK LINKS

ADDRESS

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi