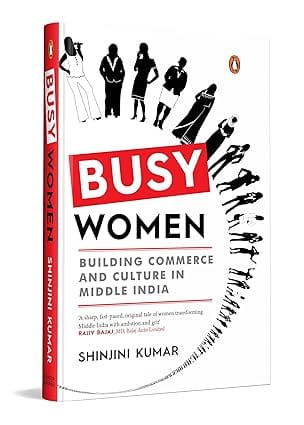

- Non-ficton

- Non-ficton

- Contemporary Fiction

- Contemporary Fiction

- Children

- Children

- Comics & Graphic Novels

- Comics & Graphic Novels

- Non-Fiction

- Non-Fiction

- Fiction

- Fiction

From Wall Street Journal columnist Spencer Jakab, the real story of the GameStop squeeze - and the surprising winners of a rigged game.

'Jakab adeptly skewers the popular but dangerously wrong narrative of Reddit's David thumping Wall Street's Goliath, and shows how the casino always wins in the end. DeepF***ingRespect for an important book with lessons far more durable than GameStop's stock market levitation.' Robin Wigglesworth, author of Trillions

During one crazy week in January 2021, a motley crew of retail traders on Reddit's r/wallstreetbets forum had seemingly done the impossible - they had brought some of the biggest, richest players on Wall Street to their knees. Their weapon was GameStop, a failing retailer whose shares briefly became the most-traded security on the planet and the subject of intense media coverage.

The Revolution That Wasn't is the riveting story of how the meme stock squeeze unfolded, and the real architects (and winners) of the GameStop rally. Drawing on his years as a stock analyst at a major bank, Jakab exposes technological and financial innovations like Robinhood as ploys to part investors from their money, within the larger story of evolving social and economic pressures. The surprising truth? What appeared to be a watershed moment - a revolution that stripped the ultra-powerful hedge funds of their market influence, placing power back in the hands of everyday investors only increased the chances of the house winning.

Online brokerages love to talk about empowerment and 'democratising finance' - while Wall Street thrives on chaos. In this nuanced analysis, Jakab shines a light on the often-misunderstood profit motives and financial

mechanisms to show how this so-called revolution is, on balance, good for Wall Street. But, Jakab argues, there really is a way for ordinary investors to beat the pros: by refusing to play their game.

Review

Ever since the GameStop saga erupted into the headlines in the winter of 2021, we've all been waiting for the definitive take. This book is it. No matter how much you think you know about Wall Street, Jakab will surprise you, infuriate you - and educate you. - Bethany McLean, bestselling co-author of The Smartest Guys in the Room and All The Devils Are Here

The saga of GameStop and other meme stocks is revealed with the skill of a thrilling whodunit. Jakab writes with an anti-Midas touch. If he touched gold, he would bring it to life. - Burton G. Malkiel, author of A Random Walk Down Wall Street

The real story of the GameStop short squeeze. Jakab walks us through every twist and turn with nuanced insight and sheds a clarifying light on the shifts happening in today's retail revolution. - Jaime Rogozinski, founder of Reddit’s WallStreetBets

An unputdownable post-mortem of the freakiest tale of pandemic-age finance - and of how investing became gamified. Jakab speaks with the key characters and highlights the structural issues, deploys the nihilistic "degen" jargon and recounts priceless anecdotes, cutting through the narrative to tell us what really happened during the GameStop short squeeze - Gian M. Volpicelli, Senior Writer, Wired

A gripping account of the social movement that took over the investing world in 2020-2021. The heroes here thought they were sticking it to the man, but became the man's stick. Jakab tells this story with warmth and humor, making financial concepts accessible to a lay audience. You will be entertained. - Scott Galloway, Professor of Marketing at NYU Stern School of Business, and New York Times bestselling author of The Four and Post Corona

A timely and hugely important book. The GameStop saga shows what happens when the little guy takes on Wall Street at its own game: there can only be one winner. Spencer Jakab is a top-drawer journalist who understands this industry inside out. I can't recommend this book highly enough. - Robin Powell, journalist, author and editor of The Evidence-Based Investor

An important look at how markets - and people - defy prediction and occasionally lose their minds. - Morgan Housel, bestselling author of The Psychology of Money

When an ailing video games retailer saw its shares soar into the stratosphere for no reason other than that newbie traders wanted to put one over on arrogant hedge funds, it was hard not to cheer David's felling of Goliath. But in this meticulous examination of the Gamestop saga, Spencer Jakab reminds us of a simple truth - the house, or in this case Wall Street, always wins in the end. - Rory Cellan-Jones, former BBC technology correspondent

About the Author

- Home

- Business and Management

- The Revolution That Wasnt How Gamestop And Reddit Made Wall Street Even Richer

The Revolution That Wasnt How Gamestop And Reddit Made Wall Street Even Richer

SIZE GUIDE

- ISBN: 9780241572627

- Author: Spencer Jakab

- Publisher: Penguin Business

- Pages: 320

- Format: Paperback

Book Description

From Wall Street Journal columnist Spencer Jakab, the real story of the GameStop squeeze - and the surprising winners of a rigged game.

'Jakab adeptly skewers the popular but dangerously wrong narrative of Reddit's David thumping Wall Street's Goliath, and shows how the casino always wins in the end. DeepF***ingRespect for an important book with lessons far more durable than GameStop's stock market levitation.' Robin Wigglesworth, author of Trillions

During one crazy week in January 2021, a motley crew of retail traders on Reddit's r/wallstreetbets forum had seemingly done the impossible - they had brought some of the biggest, richest players on Wall Street to their knees. Their weapon was GameStop, a failing retailer whose shares briefly became the most-traded security on the planet and the subject of intense media coverage.

The Revolution That Wasn't is the riveting story of how the meme stock squeeze unfolded, and the real architects (and winners) of the GameStop rally. Drawing on his years as a stock analyst at a major bank, Jakab exposes technological and financial innovations like Robinhood as ploys to part investors from their money, within the larger story of evolving social and economic pressures. The surprising truth? What appeared to be a watershed moment - a revolution that stripped the ultra-powerful hedge funds of their market influence, placing power back in the hands of everyday investors only increased the chances of the house winning.

Online brokerages love to talk about empowerment and 'democratising finance' - while Wall Street thrives on chaos. In this nuanced analysis, Jakab shines a light on the often-misunderstood profit motives and financial

mechanisms to show how this so-called revolution is, on balance, good for Wall Street. But, Jakab argues, there really is a way for ordinary investors to beat the pros: by refusing to play their game.

Review

Ever since the GameStop saga erupted into the headlines in the winter of 2021, we've all been waiting for the definitive take. This book is it. No matter how much you think you know about Wall Street, Jakab will surprise you, infuriate you - and educate you. - Bethany McLean, bestselling co-author of The Smartest Guys in the Room and All The Devils Are Here

The saga of GameStop and other meme stocks is revealed with the skill of a thrilling whodunit. Jakab writes with an anti-Midas touch. If he touched gold, he would bring it to life. - Burton G. Malkiel, author of A Random Walk Down Wall Street

The real story of the GameStop short squeeze. Jakab walks us through every twist and turn with nuanced insight and sheds a clarifying light on the shifts happening in today's retail revolution. - Jaime Rogozinski, founder of Reddit’s WallStreetBets

An unputdownable post-mortem of the freakiest tale of pandemic-age finance - and of how investing became gamified. Jakab speaks with the key characters and highlights the structural issues, deploys the nihilistic "degen" jargon and recounts priceless anecdotes, cutting through the narrative to tell us what really happened during the GameStop short squeeze - Gian M. Volpicelli, Senior Writer, Wired

A gripping account of the social movement that took over the investing world in 2020-2021. The heroes here thought they were sticking it to the man, but became the man's stick. Jakab tells this story with warmth and humor, making financial concepts accessible to a lay audience. You will be entertained. - Scott Galloway, Professor of Marketing at NYU Stern School of Business, and New York Times bestselling author of The Four and Post Corona

A timely and hugely important book. The GameStop saga shows what happens when the little guy takes on Wall Street at its own game: there can only be one winner. Spencer Jakab is a top-drawer journalist who understands this industry inside out. I can't recommend this book highly enough. - Robin Powell, journalist, author and editor of The Evidence-Based Investor

An important look at how markets - and people - defy prediction and occasionally lose their minds. - Morgan Housel, bestselling author of The Psychology of Money

When an ailing video games retailer saw its shares soar into the stratosphere for no reason other than that newbie traders wanted to put one over on arrogant hedge funds, it was hard not to cheer David's felling of Goliath. But in this meticulous examination of the Gamestop saga, Spencer Jakab reminds us of a simple truth - the house, or in this case Wall Street, always wins in the end. - Rory Cellan-Jones, former BBC technology correspondent

About the Author

User reviews

NEWSLETTER

Subscribe to get Email Updates!

Thanks for subscribing.

Your response has been recorded.

India's Iconic & Independent Book Store offering a vast selection of books across a variety of genres Since 1978.

"We Believe In The Power of Books" Our mission is to make books accessible to everyone, and to cultivate a culture of reading and learning. We strive to provide a wide range of books, from classic literature, sci-fi and fantasy, to graphic novels, biographies and self-help books, so that everyone can find something to read.

Whether you’re looking for your next great read, a gift for someone special, or just browsing, Midland is here to make your book-buying experience easy and enjoyable.

We are shipping pan India and across the world.

For Bulk Order / Corporate Gifting

+91 9818282497 |

+91 9818282497 |  [email protected]

[email protected]

Click To Know More

QUICK LINKS

ADDRESS

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi