- Non-ficton

- Non-ficton

- Contemporary Fiction

- Contemporary Fiction

- Children

- Children

- Comics & Graphic Novels

- Comics & Graphic Novels

- Non-Fiction

- Non-Fiction

- Fiction

- Fiction

'Grab some popcorn and take a front row seat, because Robin Wigglesworth has an astonishing story to tell you'

Tim Harford, author of How to Make the World Add Up

'A terrific read'

Gregory Zuckerman, author of The Man Who Solved the Market

'A fascinating journey and a crucial book'

Bradley Hope, author of Billion Dollar Whale

Fifty years ago, an unlikely group quietly assembled in the financial industry's backwaters, unified by the heretical idea that even the world's best investors couldn't beat the market in the long run. Including economist wunderkind Gene Fama, industry executive Jack Bogle, computer-obsessive John McQuown and former Second World War submariner Nate Most, the group succeeded beyond their wildest dreams.

Passive investing now likely accounts for over $26 trillion, equal to the entire gross domestic product of the US, and today is a force reshaping markets, finance and even capitalism itself.

Yet even some fans of index funds and ETFs are growing perturbed that their swelling heft is destabilizing markets, wrecking the investment industry and leading to an unwelcome concentration of power in fewer and fewer hands.

In Trillions, Financial Times journalist Robin Wigglesworth unveils the vivid secret history of index funds, bringing to life the colourful characters behind their birth, growth and evolution into a world-conquering phenomenon. It is the untold story behind one of the most pressing financial uncertainties of our time.

'An easy-to-understand and fun read, full of lively characters and little-known details of how finance really works today' Gillian Tett, US editor-at-large at the Financial Times and author of Anthro-Vision

Review

Trillions is both entertaining and educational. Wigglesworth explores one of the most important modern-day financial innovations and explains its broad impact on financial markets, investors, global economies and even capitalism. A terrific read and a topic that will become more important as passive investments increasingly dominate markets. Wigglesworth brings what could be a dull topic to full life - Gregory Zuckerman, special writer at the Wall Street Journal and author of The Man Who Solved the Market

As only the incomparable Robin Wigglesworth could do, in Trillions he turns the often obscured history of the investment industry into a rollicking great yarn, replete with admirable heroes, political infighting, fascinating diversions and unexpected triumphs - William Cohan, special correspondent at Vanity Fair and author of The Last Tycoons

Very few writers can tell a great story and help us understand a big idea. Robin Wigglesworth is one of those rare journalists who can. His history of the index fund is required reading for anyone who wants to know where the financial markets have come, and where they are going. It's also just a wonderfully engaging romp through the last half century of market news

- Rana Foroohar, global business columnist at the Financial Times and author of Don't Be EvilThis is a tour de force. Passive investing has become a bedrock of finance but very few investors understand where and how this practice emerged from and how it is changing markets in a way that impacts us all. Wigglesworth has turned this arcane tale into an easy-to-understand and fun read, full of lively characters and little known details of how finance really works today. Anyone who wants to understand modern investing should read it - Gillian Tett, chair of the editorial board and US editor-at-large at the Financial Times and author of Fool's Gold

A real tour de force, this engaging and thought-provoking book brings together several historical threads - from Warren Buffett's famous hedge fund bet to the 'Manhattan Project of financial economics' - to show how passive investing and index funds have evolved into an ETF phenomenon that has 'humble[d] the investment industry ... reshape[d] finance forever,' and now poses risks for future financial stability and economic wellbeing - Mohamed El Erian, Chief Economic Adviser of Allianz and author of When Markets Collide

The greatest change in investing in the last 100 years is brought to life like never before. A page turner! - Fred Grauer, former CEO of Wells Fargo Investment Advisors

Robin Wigglesworth is one of the most lucid and exciting journalists writing about finance today. Trillions tackles the enormous changes that have swept the investing world through the stories of its charismatic innovators. It's a fascinating journey and a crucial book for anyone trying to understand the financial markets - Bradley Hope, writer at Project Brazen and author of Billion Dollar Whale

About the Author

- Home

- Non-Fiction

- Trillions: How A Band Of Wall Street Renegades Invented The Index Fund And Changed Finance Forever

Trillions: How A Band Of Wall Street Renegades Invented The Index Fund And Changed Finance Forever

SIZE GUIDE

- ISBN :9780241422069

- Author: Robin Wigglesworth

- Publisher: Penguin Business

- Pages: 224

- Format: Paperback

Book Description

'Grab some popcorn and take a front row seat, because Robin Wigglesworth has an astonishing story to tell you'

Tim Harford, author of How to Make the World Add Up

'A terrific read'

Gregory Zuckerman, author of The Man Who Solved the Market

'A fascinating journey and a crucial book'

Bradley Hope, author of Billion Dollar Whale

Fifty years ago, an unlikely group quietly assembled in the financial industry's backwaters, unified by the heretical idea that even the world's best investors couldn't beat the market in the long run. Including economist wunderkind Gene Fama, industry executive Jack Bogle, computer-obsessive John McQuown and former Second World War submariner Nate Most, the group succeeded beyond their wildest dreams.

Passive investing now likely accounts for over $26 trillion, equal to the entire gross domestic product of the US, and today is a force reshaping markets, finance and even capitalism itself.

Yet even some fans of index funds and ETFs are growing perturbed that their swelling heft is destabilizing markets, wrecking the investment industry and leading to an unwelcome concentration of power in fewer and fewer hands.

In Trillions, Financial Times journalist Robin Wigglesworth unveils the vivid secret history of index funds, bringing to life the colourful characters behind their birth, growth and evolution into a world-conquering phenomenon. It is the untold story behind one of the most pressing financial uncertainties of our time.

'An easy-to-understand and fun read, full of lively characters and little-known details of how finance really works today' Gillian Tett, US editor-at-large at the Financial Times and author of Anthro-Vision

Review

Trillions is both entertaining and educational. Wigglesworth explores one of the most important modern-day financial innovations and explains its broad impact on financial markets, investors, global economies and even capitalism. A terrific read and a topic that will become more important as passive investments increasingly dominate markets. Wigglesworth brings what could be a dull topic to full life - Gregory Zuckerman, special writer at the Wall Street Journal and author of The Man Who Solved the Market

As only the incomparable Robin Wigglesworth could do, in Trillions he turns the often obscured history of the investment industry into a rollicking great yarn, replete with admirable heroes, political infighting, fascinating diversions and unexpected triumphs - William Cohan, special correspondent at Vanity Fair and author of The Last Tycoons

Very few writers can tell a great story and help us understand a big idea. Robin Wigglesworth is one of those rare journalists who can. His history of the index fund is required reading for anyone who wants to know where the financial markets have come, and where they are going. It's also just a wonderfully engaging romp through the last half century of market news

- Rana Foroohar, global business columnist at the Financial Times and author of Don't Be EvilThis is a tour de force. Passive investing has become a bedrock of finance but very few investors understand where and how this practice emerged from and how it is changing markets in a way that impacts us all. Wigglesworth has turned this arcane tale into an easy-to-understand and fun read, full of lively characters and little known details of how finance really works today. Anyone who wants to understand modern investing should read it - Gillian Tett, chair of the editorial board and US editor-at-large at the Financial Times and author of Fool's Gold

A real tour de force, this engaging and thought-provoking book brings together several historical threads - from Warren Buffett's famous hedge fund bet to the 'Manhattan Project of financial economics' - to show how passive investing and index funds have evolved into an ETF phenomenon that has 'humble[d] the investment industry ... reshape[d] finance forever,' and now poses risks for future financial stability and economic wellbeing - Mohamed El Erian, Chief Economic Adviser of Allianz and author of When Markets Collide

The greatest change in investing in the last 100 years is brought to life like never before. A page turner! - Fred Grauer, former CEO of Wells Fargo Investment Advisors

Robin Wigglesworth is one of the most lucid and exciting journalists writing about finance today. Trillions tackles the enormous changes that have swept the investing world through the stories of its charismatic innovators. It's a fascinating journey and a crucial book for anyone trying to understand the financial markets - Bradley Hope, writer at Project Brazen and author of Billion Dollar Whale

About the Author

User reviews

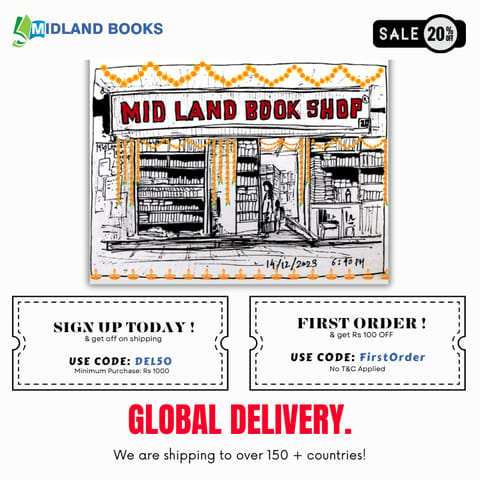

NEWSLETTER

Subscribe to get Email Updates!

Thanks for subscribing.

Your response has been recorded.

India's Iconic & Independent Book Store offering a vast selection of books across a variety of genres Since 1978.

"We Believe In The Power of Books" Our mission is to make books accessible to everyone, and to cultivate a culture of reading and learning. We strive to provide a wide range of books, from classic literature, sci-fi and fantasy, to graphic novels, biographies and self-help books, so that everyone can find something to read.

Whether you’re looking for your next great read, a gift for someone special, or just browsing, Midland is here to make your book-buying experience easy and enjoyable.

We are shipping pan India and across the world.

For Bulk Order / Corporate Gifting

+91 9818282497 |

+91 9818282497 |  [email protected]

[email protected]

Click To Know More

INFORMATION

QUICK LINKS

ADDRESS

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi