WELCOME TO MIDLAND BOOK SHOP!

SHOP FOR

-

Contemporary Fiction

- Contemporary Fiction

-

Children

- Children

-

Comics & Graphic Novels

- Comics & Graphic Novels

-

Non-Fiction

- Non-Fiction

-

Fiction

- Fiction

Shop No.20, Aurobindo Palace Market, Hauz Khas, Near Church +91 9818282497 | 011 26867121

110016

New Delhi

IN

Midland The Book Shop ™

Shop No.20, Aurobindo Palace Market, Hauz Khas, Near Church +91 9818282497 | 011 26867121

New Delhi,

IN

+919871604786

https://www.midlandbookshop.com/s/607fe93d7eafcac1f2c73ea4/677cda367903fd013d69b606/without-tag-line-480x480.png"

[email protected]

9789355430557

635fb269d63f299645abd143

How To Make Money Through Breakout Trading - Analyse Stock Market Through Candlestick Charts

https://www.midlandbookshop.com/s/607fe93d7eafcac1f2c73ea4/635fb280d63f299645abd20d/41ytqw8idvl-_sx324_bo1-204-203-200_.jpg

9789355430557

It’s important to understand that there are two different herds that exist in stock market trading. 1. Smart Money, and 2. Dumb Money ‘Smart Money’ refers to institutional investors, the big sharks who have money and information power, who give direction and momentum to markets. ‘Dumb Money’ refers to non-professional retail traders, who often try to make quick money. Wouldn’t you agree that it’s always a good idea to follow smart money? Besides, did you know only the ‘Entry’ and ‘Exit’ decide the fate of your trade, irrespective of your reputation, experience, and qualification? This book explains the secrets of identifying the trading activity of smart money. It enables you to differentiate a genuine breakout from a false breakout.

About the Author

Indrazith Shantharaj is a full-time stock market trader and a bestselling author. He applies the concepts of Market Profiling, with systems tailor-made for the Indian stock market conditions. He is a former IT professional and has over ten years of experience in the stock market. His articles and free eBooks can be found at www.profiletraders.in. Apart from trading, he spends his free time on travel and adventure. Indrazith believes in using the power of the MIND extensively, and practices spiritual sadhana.

in stock

INR

239

1

1

Email ID already exists!

Your Current password is incorrect

Password Updated Successfully

Thanks for your Feedback

- Home

- Business And Economics

- How To Make Money Through Breakout Trading - Analyse Stock Market Through Candlestick Charts

How To Make Money Through Breakout Trading - Analyse Stock Market Through Candlestick Charts

ISBN:

9789355430557

₹239

₹299

(20% OFF)

SIZE GUIDE

Sold By:

Hauz Khas - Aurobindo Market

Details

- ISBN: 9789355430557

- Author: Indrazith Santharaj

- Publisher: Manjul

- Pages: 82

- Format: Paperback

Book Description

It’s important to understand that there are two different herds that exist in stock market trading. 1. Smart Money, and 2. Dumb Money ‘Smart Money’ refers to institutional investors, the big sharks who have money and information power, who give direction and momentum to markets. ‘Dumb Money’ refers to non-professional retail traders, who often try to make quick money. Wouldn’t you agree that it’s always a good idea to follow smart money? Besides, did you know only the ‘Entry’ and ‘Exit’ decide the fate of your trade, irrespective of your reputation, experience, and qualification? This book explains the secrets of identifying the trading activity of smart money. It enables you to differentiate a genuine breakout from a false breakout.

About the Author

Indrazith Shantharaj is a full-time stock market trader and a bestselling author. He applies the concepts of Market Profiling, with systems tailor-made for the Indian stock market conditions. He is a former IT professional and has over ten years of experience in the stock market. His articles and free eBooks can be found at www.profiletraders.in. Apart from trading, he spends his free time on travel and adventure. Indrazith believes in using the power of the MIND extensively, and practices spiritual sadhana.

User reviews

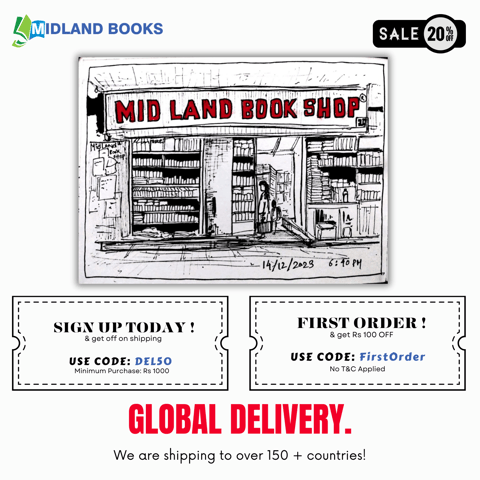

NEWSLETTER

Subscribe to get Email Updates!

Thanks for subscribing.

Your response has been recorded.

India's Iconic & Independent Book Store offering a vast selection of books across a variety of genres Since 1978.

"We Believe In The Power of Books" Our mission is to make books accessible to everyone, and to cultivate a culture of reading and learning. We strive to provide a wide range of books, from classic literature, sci-fi and fantasy, to graphic novels, biographies and self-help books, so that everyone can find something to read.

Whether you’re looking for your next great read, a gift for someone special, or just browsing, Midland is here to make your book-buying experience easy and enjoyable.

We are shipping pan India and across the world.

For Bulk Order / Corporate Gifting

+91 9818282497 |

+91 9818282497 |  [email protected]

[email protected]

Click To Know More

INFORMATION

POLICIES

ACCOUNT

QUICK LINKS

ADDRESS

Midland Book Shop - Hauz Khas

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi

Shop No.20, Aurobindo Palace Market, Near Church, New Delhi