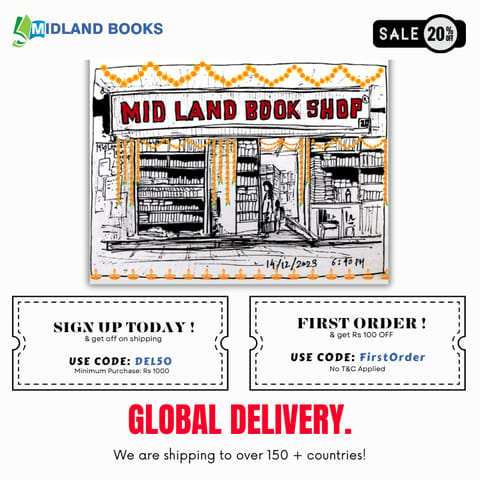

WELCOME TO MIDLAND BOOK SHOP!

SHOP FOR

- Non-ficton

- Non-ficton

- Contemporary Fiction

- Contemporary Fiction

- Children

- Children

- Comics & Graphic Novels

- Comics & Graphic Novels

- Non-Fiction

- Non-Fiction

- Fiction

- Fiction

Shop No.20, Aurobindo Palace Market, Hauz Khas, Near Church +91 9818282497 | 011 26867121 110016 New Delhi IN

Midland The Book Shop ™

Shop No.20, Aurobindo Palace Market, Hauz Khas, Near Church +91 9818282497 | 011 26867121 New Delhi, IN

+919871604786 https://www.midlandbookshop.com/s/607fe93d7eafcac1f2c73ea4/677cda367903fd013d69b606/without-tag-line-480x480.png" [email protected]9780593189436 61f3d94c684e7741b11a8cf7 The Platform Delusion Who Wins And Who Loses In The Age Of Tech Titans https://www.midlandbookshop.com/s/607fe93d7eafcac1f2c73ea4/61f3d94d684e7741b11a8d13/41yrghyo-is-_sx329_bo1-204-203-200_.jpg 9780593189436

An investment banker and professor explains what really drives success in the tech economy

Many think that they understand the secrets to the success of the biggest tech companies: Facebook, Amazon, Apple, Netflix, and Google. It's the platform economy, or network effects, or some other magical power that makes their ultimate world domination inevitable. Investment banker and professor Jonathan Knee argues that the truth is much more complicated--but entrepreneurs and investors can understand what makes the giants work, and learn the keys to lasting success in the digital economy.

Knee explains what really makes the biggest tech companies work: a surprisingly disparate portfolio of structural advantages buttressed by shrewd acquisitions, strong management, lax regulation, and often, encouraging the myth that they are invincible to discourage competitors. By offering fresh insights into the true sources of strength and very real vulnerabilities of these companies, The Platform Delusion shows how investors, existing businesses, and startups might value them, compete with them, and imitate them.

The Platform Delusion demystifies the success of the biggest digital companies in sectors from retail to media to software to hardware, offering readers what those companies don't want everyone else to know. Knee's insights are invaluable for entrepreneurs and investors in digital businesses seeking to understand what drives resilience and profitability for the long term.

Many think that they understand the secrets to the success of the biggest tech companies: Facebook, Amazon, Apple, Netflix, and Google. It's the platform economy, or network effects, or some other magical power that makes their ultimate world domination inevitable. Investment banker and professor Jonathan Knee argues that the truth is much more complicated--but entrepreneurs and investors can understand what makes the giants work, and learn the keys to lasting success in the digital economy.

Knee explains what really makes the biggest tech companies work: a surprisingly disparate portfolio of structural advantages buttressed by shrewd acquisitions, strong management, lax regulation, and often, encouraging the myth that they are invincible to discourage competitors. By offering fresh insights into the true sources of strength and very real vulnerabilities of these companies, The Platform Delusion shows how investors, existing businesses, and startups might value them, compete with them, and imitate them.

The Platform Delusion demystifies the success of the biggest digital companies in sectors from retail to media to software to hardware, offering readers what those companies don't want everyone else to know. Knee's insights are invaluable for entrepreneurs and investors in digital businesses seeking to understand what drives resilience and profitability for the long term.

Review

“In ‘The Platform Delusion’ Jonathan Knee takes apart the magical aura of one of Silicon Valley's biggest conceptual exports." —The New York Times

"A cogent, arresting argument...Knee’s untangling of the complexities of platforms and their backers is steadily accessible and surprising." —Publishers Weekly

“In pursuit of what makes for a powerful and successful tech company, The Platform Delusion by Jonathan A Knee opts for the broad scope.” —Financial Times

“Every generation flatters itself by thinking it has reinvented the rules of business. Knee’s book is a jolting and often hilarious exposure of our delusions that teaches, once again, that the fundamentals of business may not have changed quite as much as you think they have. Everyone should read this book.” —Tim Wu, author of The Curse of Bigness

“Jonathan Knee mercilessly cuts through the hype and wishful thinking about America’s best-known tech giants to show which really has the coveted competitive advantages likely to reward investors. I can almost guarantee you’ll be as surprised as I was.” —James B. Stewart, Pulitzer Prize–winning author of Disney Wars

“In the worlds of business and investing, the word ‘platform’ has acquired an almost magical significance. Many believe that the term can manifest wealth and prestige for a business. But what does the word really mean? When does it mislead? And how ultimately should we as a society manage the role these businesses play in our life? It’s critical questions like these that Jonathan Knee wrestles with and answers in his important new book, The Platform Delusion.” —Bethany McLean, contributing editor, Vanity Fair, and author of The Smartest Guys in the Room and All the Devils Are Here

“Jonathan Knee has done it again. He identifies where value actually comes from in platform companies. (Spoiler alert: competitive advantage, just like your economics professor taught you.) The book is a must read for students of platform companies and their valuation.” —Glenn Hubbard, Russell L. Carson Professor of Economics and Finance and Dean Emeritus at Columbia Business School

“Essential reading if you really want to understand the age of the digital giants. Jonathan Knee brushes magical thinking and Silicon Valley hype aside and makes a compelling case that while technology changes, the fundamentals of business never do.” —Mark Thompson, chairman of Ancestry and former CEO and president at The New York Times Company

“Jonathan combines the gimlet eye of a banker with the methodical rigor of an academic to produce a deeply thought-out look at the innards of tech industry business models.” —Mark Colodny, co-head of private equity and global head of technology at Warburg Pincus

“The nation’s best business writer.” —Michael Wolff, USA Today

"A cogent, arresting argument...Knee’s untangling of the complexities of platforms and their backers is steadily accessible and surprising." —Publishers Weekly

“In pursuit of what makes for a powerful and successful tech company, The Platform Delusion by Jonathan A Knee opts for the broad scope.” —Financial Times

“Every generation flatters itself by thinking it has reinvented the rules of business. Knee’s book is a jolting and often hilarious exposure of our delusions that teaches, once again, that the fundamentals of business may not have changed quite as much as you think they have. Everyone should read this book.” —Tim Wu, author of The Curse of Bigness

“Jonathan Knee mercilessly cuts through the hype and wishful thinking about America’s best-known tech giants to show which really has the coveted competitive advantages likely to reward investors. I can almost guarantee you’ll be as surprised as I was.” —James B. Stewart, Pulitzer Prize–winning author of Disney Wars

“In the worlds of business and investing, the word ‘platform’ has acquired an almost magical significance. Many believe that the term can manifest wealth and prestige for a business. But what does the word really mean? When does it mislead? And how ultimately should we as a society manage the role these businesses play in our life? It’s critical questions like these that Jonathan Knee wrestles with and answers in his important new book, The Platform Delusion.” —Bethany McLean, contributing editor, Vanity Fair, and author of The Smartest Guys in the Room and All the Devils Are Here

“Jonathan Knee has done it again. He identifies where value actually comes from in platform companies. (Spoiler alert: competitive advantage, just like your economics professor taught you.) The book is a must read for students of platform companies and their valuation.” —Glenn Hubbard, Russell L. Carson Professor of Economics and Finance and Dean Emeritus at Columbia Business School

“Essential reading if you really want to understand the age of the digital giants. Jonathan Knee brushes magical thinking and Silicon Valley hype aside and makes a compelling case that while technology changes, the fundamentals of business never do.” —Mark Thompson, chairman of Ancestry and former CEO and president at The New York Times Company

“Jonathan combines the gimlet eye of a banker with the methodical rigor of an academic to produce a deeply thought-out look at the innards of tech industry business models.” —Mark Colodny, co-head of private equity and global head of technology at Warburg Pincus

“The nation’s best business writer.” —Michael Wolff, USA Today

About the Author

Jonathan A. Knee is the author of The Accidental Investment Banker: Inside the Decade That Transformed Wall Street and the co-author of The Curse of the Mogul. Professor Knee’s writing has appeared in The Atlantic, the Wall Street Journal, the New York Times and elsewhere. Knee is a Professor of Finance and Economics at the Columbia Graduate School of Business, and has previously taught at Northwestern University. He is also a Senior Advisor at Evercore Partners, a boutique investment banking firm. Before joining Evercore, he was a managing director and co-head of Morgan Stanley's Media Group.

Excerpt. © Reprinted by permission. All rights reserved.

The Four Pillars of the Platform Delusion

The Platform Delusion most often manifests itself subtly, as an unspoken assumption underlying confident assertions regarding the direction of the economy or the imagined invincibility of a particular enterprise. Regardless of exact terminology-"the platform economy," "the platform revolution," and "the platform effect" have emerged as common terms-the central fallacy relies on a consistent mythology and the confident expectation of world domination by a select few megaplatforms. This conventional wisdom rests overwhelmingly on four core pillars of belief.

Each of these is demonstrably false.

The Core Tenets of the Platform Delusion

1. Platforms Are a Revolutionary New Business Model.

2. Digital Platforms Are Structurally Superior to Analog Platforms.

3. All Platforms Exhibit Powerful Network Effects.

4. Network Effects Lead Inexorably to Winner-Take-All Markets.

Platforms Are a Revolutionary New Business Model

It is true that business school professors only started writing in earnest about platform business models after 2000. But it is a terrible mistake to date a social or economic phenomenon only from the moment that academics decided to take note. Well before the internet was even conceived, much less commercialized, the average consumer interacted with platform businesses on a daily basis.

The definition of a "platform" business is straightforward. Although they take many forms, what platforms have in common is that their core value proposition lies in the connections they enable and enhance. "They bring together individuals and organizations," a recent review of platform businesses and research summarized, "so they can innovate or interact in ways not otherwise possible."

The persistent confusion regarding what constitutes a platform business, despite the relatively simple definition, is mostly due to unhelpful market incentives. As is often the case, when a moniker emerges that affords a premium valuation, all manner of enterprises twist themselves in knots to claim a credible association with the term. So, for instance, it should not be surprising that a fast-food salad chain would promote itself as a "food platform." The company, Sweetgreen, has even attracted a distinguished Harvard Business School professor to the board to lend legitimacy to the pitch.

That said, the diversity of connections made possible by the internet has spawned a mind-boggling array of legitimate platform businesses, often with very different business models. Sometimes the platform's source of value comes from a financial transaction by matching a buyer and a seller in a marketplace, sometimes it comes from facilitating innovation through the addition of functionality and content to a shared environment like a gaming platform, and sometimes it comes just from the interaction itself, as in the case of a social network. This explosion of new platforms has led to a strange amnesia regarding the ubiquity of platform businesses long before the dawn of the digital age.

Some of the platform businesses that predated the internet were primarily electronic, like credit cards. Introduced by Diners Club in 1950 and pervasive by the 1970s after the establishment of American Express, Visa and Mastercard, credit cards serve as a platform on which merchants and customers can transact. By the end of 2020, Visa was worth almost half a trillion dollars, with Mastercard not far behind.

Other long-established platform businesses are physical, like the iconic malls that connect retailers with shoppers throughout the country. The Southdale Center in Edina, Minnesota, generally identified as the first modern shopping mall, opened in 1956 and still operates today. Movie theaters similarly are platform businesses. Exhibitors negotiate with studios to get the best films on the best terms and market the experience to local moviegoers. The ability to get the best films is in part a function of the credibility of their claim to be able to attract the biggest possible audience, and their ability to fill the theater will be in part a function of the films they secure.

This chicken-and-egg dynamic inherent in platform businesses has not fundamentally changed with the internet. Operators face the same basic business issues-who and how to charge, encouraging platform loyalty, and "traffic" monetization strategies, for instance-in seeking to build and maintain successful multisided platforms.

What is surprising is that it took so long for it to occur to anyone to study the structure and economics of platform businesses. Nobel Prize-winning economist Jean Tirole is the coauthor of an article from 2003 which, if not the absolute first to examine the phenomenon, is most widely cited and appears to have launched the avalanche of research and publications that have followed. Interestingly, given the supposed connection between the "discovery" of platforms and the availability of the internet, the seminal article was not published in a US journal despite that the most notable digital platforms of scale were developed here.

The authors of this groundbreaking article seem slightly bemused that the topic had previously attracted such "scant attention" despite decades of research focused on network economics and chicken-and-egg problems. What's more, although some internet businesses are discussed, most of the examples used in their analysis (including video games, credit cards, and operating systems) substantially predate the internet and in many cases (like discount coupon books, shopping malls, and real estate brokers) are decidedly low-tech. This has not dissuaded the media or other academics from characterizing Tiroles' intellectual contribution as somehow applying uniquely or differently to "Internet-era companies."

The conviction that platforms are something new and different seems only to have intensified in recent years. The term "platform" has entered the vernacular with a vengeance, as a review of search terms over the past decade reveals. Whether this coincides with a corresponding increase in understanding of the distinguishing characteristics of platform businesses seems questionable at best.

Digital Platforms Are Structurally Superior to Analog Platforms

Even if platforms are not a new concept, the internet has vastly expanded the range, scope, and size of potential platform businesses. In many cases, these new digital models have proved devastating to long-established franchises. But bigger is not always better, and the ability to upend does not always signal a capability of creating lasting value.

The undeniable, sometimes shocking strength of the handful of the largest digital platforms established in recent decades-Google and Facebook in particular-has led to a broader assumption that digital platforms are consistently better businesses than the analog equivalents. This is an assumption that does not bear up to scrutiny. It has also proven costly to many investors.

A comparison of the key business characteristics of one familiar analog platform and its digital equivalent demonstrates the depth of this fallacy. Shopping malls and their digital counterpart, e-commerce websites, represent the simplest of two-sided platforms connecting sellers and buyers.

Traditional malls had two major benefits: their vendors were committed to long-term leases and their shoppers' next best option was many miles away. Before committing to construction, a mall developer will typically secure a handful of anchor tenants and often obtain not only an extended commitment, but a promise not to open any other stores within a certain distance of the mall. The original site-selection process incorporates considerations of demographics, shopping alternatives, and land cost and availability. A key analysis here is to confirm that the subsequent establishment of a competing nearby mall is impractical. These features ensure that the mall operator is able to secure superior returns for its investors.

On the internet, the platform's relationships with both buyer and seller typically exhibit none of this durability. Alternatives for buyers are only a click away, and sophisticated sellers dynamically optimize their ability to reach customers across competing platforms or directly. There are few levers a digital commerce platform can pull to combat this structural reality. Estimates of e-commerce failure rates are as high as 97 percent.

The case of Amazon is complex and the subject of its own chapter. It is worth noting, however, that the most successful operators in the shopping-center sector are wildly more profitable than Amazon's e-commerce operations. The point isn't that you would rather invest in a mall operator than Amazon during a pandemic but simply that off-line business models have surprising relative resilience. It is not a coincidence that, despite the secular trends, right up until the COVID-19 crisis hit, struggling online retailers were increasingly looking to solve their structural woes by opening up mall outlets!

A disproportionate number of the earliest dot-com flameouts-names like Pets.com, Kozmo, Boo.com, and Webvan-were e-commerce companies. These elicit some nostalgia for those of us who lived through the first internet boom but likely cause recurring nightmares for some of the biggest names in venture capital who actually backed them.

The more recent entries into the category have hardly proven much more resilient, although remarkably this has not seemed to significantly dampen the willingness of public and private investors to aggressively finance the category. The "flash sale" craze lasted a few years and briefly produced its own signature unicorn, Gilt Groupe. Online deal marketplace Groupon's 2011 IPO was the largest since Google's in 2004, valuing the company at well over $10 billion. Today, it is a largely forgotten microcap. In 2019, the highest profile crop of e-commerce IPOs, Jumia, Revolve, and Chewy-targeting commerce in Africa, clothing, and pet products, respectively-all soared on their first day of trading but ended the year at a small fraction of the value reflected by that initial euphoria.

Although COVID-19 initially interrupted the IPO dreams of many in the planned e-commerce class of 2020-for instance Poshmark, another fashion retailer, which had previously delayed its IPO-the sector dramatically recovered as investors came to believe in a permanent shift to online buying. Casper, in bedding, tapped the public markets just before the full force of the pandemic was felt and lost 75 percent of its value in the first month-but managed to regain at least some of its IPO price by year end. More dramatically, the once unloved Chewy, described as the Pets.com of the current era, exploded to a market capitalization of over $40 billion. And in September, Poshmark went ahead and filed its IPO paperwork, ultimately becoming one of the earliest hot offerings of 2021. Shifting market sentiment, however, can only mask the fundamental economics of e-commerce for so long.

Digital retail environments provide consumers with bountiful information with respect to both price and product options. But the friend of the buyer is typically the enemy of the seller-as power shifts to consumers and away from producers, exceptional profit opportunities become rare. Online commerce may have been correctly identified as one of the first "killer apps" of the World Wide Web, but overwhelmingly who gets killed are the investors in these businesses.

Of course, all digital commerce businesses are not the same, and these important distinctions are examined more closely later. Some are pure platforms that simply connect buyer and seller, such as eBay. Others, like Casper, actually are the seller themselves and sometimes even the manufacturer. And still others, like Amazon, operate a hybrid model of some sort. And there are large e-commerce sectors, like online travel businesses, that sell services rather than things. Despite their diversity of business models and products, as a group they are surprisingly consistent in at least one regard: disappointing financial performance over time.

During the quarter century since the birth of the commercial internet, dozens of companies in some form of e-commerce have gone public. Almost a quarter have gone bankrupt or delisted. Of those that managed to get acquired before facing that unpleasant prospect, over two thirds sold out for less than their original public offering price. Of the third that remain public companies, over 60 percent have lagged the overall market since their respective IPOs.

All Platforms Exhibit Powerful Network Effects

The imagined talismanic qualities of platform business models are often attributed to the inherent availability of an important economic phenomenon known as "network effects." Sometimes also referred to as the "flywheel effect," it means that every new user increases the value of the network to existing users.

What is so irresistible about network effects is their potential to feed off themselves. There is something compelling about the virtuous circle of steadily increasing advantage reflected in the most successful businesses built on network effects. In theory, every new user increases the relative attractiveness of the business, simultaneously attracting still more new users and making the prospect of successful competitive attack ever more remote.

The logical association between platform businesses and network effects is understandable. Platforms, after all, are generally in the business of managing and facilitating the interaction among network participants. But it is a mistake to conclude that all platforms are powered by strong network effects. In fact, plenty of platform businesses receive little assistance from network effects.

For instance, all ad-supported media businesses, from television broadcasters to internet content providers, serve as platforms to connect advertisers and consumers. The "water cooler" effect may generate some psychic benefit from knowing that others share your interests and advertisers are undoubtedly attracted to a larger audience, but the economics of these businesses are primarily driven by traditional fixed-cost scale. It is the production of hit shows and compelling web content that power these businesses, not network effects either between or among viewers and advertisers. When the content succeeds, the significant fixed infrastructure costs can be spread across the heightened revenue base generated by attracting more viewers and better advertising rates.

Similarly, movie theaters, as noted earlier, represent platforms connecting moviegoers and studios. Their economics, however, have little to do with network effects. Rather, relative profitability has historically been predominantly a function of whether the theaters are regionally clustered in small markets that support few theaters or spread nationally across highly competitive big cities.

Even Zoom, the video communications platform that is perhaps the most iconic success of the pandemic era, is not really a strong network effects business. By the end of 2020, the company was worth over $100 billion and its stock traded at around ten times its 2019 offering price. Zoom is a fabulous product, but its very success in eliminating any friction or complexity in adoption has severely limited how powerful its network effects can be. At this point, multiple competitive products also permit participation by simply clicking on a browser link, so obtaining access to the broadest possible pool of potential network participants is not a differentiator. Without any meaningful costs of switching or real challenges in coordinating among users, the value of any network effects is limited.

It is true that most platform businesses do exhibit network effects. Nonetheless, even where they exist, the nature, extent, and impact of the effects on the attractiveness of the enterprises vary widely. Finally, when, as in the case of Facebook, strong network effects are a crucial feature of a powerful digital platform, there is invariably more to the story. Understanding whether and why to invest in a platform business requires an examination of multiple factors well beyond the presence of network effects.

The Platform Delusion most often manifests itself subtly, as an unspoken assumption underlying confident assertions regarding the direction of the economy or the imagined invincibility of a particular enterprise. Regardless of exact terminology-"the platform economy," "the platform revolution," and "the platform effect" have emerged as common terms-the central fallacy relies on a consistent mythology and the confident expectation of world domination by a select few megaplatforms. This conventional wisdom rests overwhelmingly on four core pillars of belief.

Each of these is demonstrably false.

The Core Tenets of the Platform Delusion

1. Platforms Are a Revolutionary New Business Model.

2. Digital Platforms Are Structurally Superior to Analog Platforms.

3. All Platforms Exhibit Powerful Network Effects.

4. Network Effects Lead Inexorably to Winner-Take-All Markets.

Platforms Are a Revolutionary New Business Model

It is true that business school professors only started writing in earnest about platform business models after 2000. But it is a terrible mistake to date a social or economic phenomenon only from the moment that academics decided to take note. Well before the internet was even conceived, much less commercialized, the average consumer interacted with platform businesses on a daily basis.

The definition of a "platform" business is straightforward. Although they take many forms, what platforms have in common is that their core value proposition lies in the connections they enable and enhance. "They bring together individuals and organizations," a recent review of platform businesses and research summarized, "so they can innovate or interact in ways not otherwise possible."

The persistent confusion regarding what constitutes a platform business, despite the relatively simple definition, is mostly due to unhelpful market incentives. As is often the case, when a moniker emerges that affords a premium valuation, all manner of enterprises twist themselves in knots to claim a credible association with the term. So, for instance, it should not be surprising that a fast-food salad chain would promote itself as a "food platform." The company, Sweetgreen, has even attracted a distinguished Harvard Business School professor to the board to lend legitimacy to the pitch.

That said, the diversity of connections made possible by the internet has spawned a mind-boggling array of legitimate platform businesses, often with very different business models. Sometimes the platform's source of value comes from a financial transaction by matching a buyer and a seller in a marketplace, sometimes it comes from facilitating innovation through the addition of functionality and content to a shared environment like a gaming platform, and sometimes it comes just from the interaction itself, as in the case of a social network. This explosion of new platforms has led to a strange amnesia regarding the ubiquity of platform businesses long before the dawn of the digital age.

Some of the platform businesses that predated the internet were primarily electronic, like credit cards. Introduced by Diners Club in 1950 and pervasive by the 1970s after the establishment of American Express, Visa and Mastercard, credit cards serve as a platform on which merchants and customers can transact. By the end of 2020, Visa was worth almost half a trillion dollars, with Mastercard not far behind.

Other long-established platform businesses are physical, like the iconic malls that connect retailers with shoppers throughout the country. The Southdale Center in Edina, Minnesota, generally identified as the first modern shopping mall, opened in 1956 and still operates today. Movie theaters similarly are platform businesses. Exhibitors negotiate with studios to get the best films on the best terms and market the experience to local moviegoers. The ability to get the best films is in part a function of the credibility of their claim to be able to attract the biggest possible audience, and their ability to fill the theater will be in part a function of the films they secure.

This chicken-and-egg dynamic inherent in platform businesses has not fundamentally changed with the internet. Operators face the same basic business issues-who and how to charge, encouraging platform loyalty, and "traffic" monetization strategies, for instance-in seeking to build and maintain successful multisided platforms.

What is surprising is that it took so long for it to occur to anyone to study the structure and economics of platform businesses. Nobel Prize-winning economist Jean Tirole is the coauthor of an article from 2003 which, if not the absolute first to examine the phenomenon, is most widely cited and appears to have launched the avalanche of research and publications that have followed. Interestingly, given the supposed connection between the "discovery" of platforms and the availability of the internet, the seminal article was not published in a US journal despite that the most notable digital platforms of scale were developed here.

The authors of this groundbreaking article seem slightly bemused that the topic had previously attracted such "scant attention" despite decades of research focused on network economics and chicken-and-egg problems. What's more, although some internet businesses are discussed, most of the examples used in their analysis (including video games, credit cards, and operating systems) substantially predate the internet and in many cases (like discount coupon books, shopping malls, and real estate brokers) are decidedly low-tech. This has not dissuaded the media or other academics from characterizing Tiroles' intellectual contribution as somehow applying uniquely or differently to "Internet-era companies."

The conviction that platforms are something new and different seems only to have intensified in recent years. The term "platform" has entered the vernacular with a vengeance, as a review of search terms over the past decade reveals. Whether this coincides with a corresponding increase in understanding of the distinguishing characteristics of platform businesses seems questionable at best.

Digital Platforms Are Structurally Superior to Analog Platforms

Even if platforms are not a new concept, the internet has vastly expanded the range, scope, and size of potential platform businesses. In many cases, these new digital models have proved devastating to long-established franchises. But bigger is not always better, and the ability to upend does not always signal a capability of creating lasting value.

The undeniable, sometimes shocking strength of the handful of the largest digital platforms established in recent decades-Google and Facebook in particular-has led to a broader assumption that digital platforms are consistently better businesses than the analog equivalents. This is an assumption that does not bear up to scrutiny. It has also proven costly to many investors.

A comparison of the key business characteristics of one familiar analog platform and its digital equivalent demonstrates the depth of this fallacy. Shopping malls and their digital counterpart, e-commerce websites, represent the simplest of two-sided platforms connecting sellers and buyers.

Traditional malls had two major benefits: their vendors were committed to long-term leases and their shoppers' next best option was many miles away. Before committing to construction, a mall developer will typically secure a handful of anchor tenants and often obtain not only an extended commitment, but a promise not to open any other stores within a certain distance of the mall. The original site-selection process incorporates considerations of demographics, shopping alternatives, and land cost and availability. A key analysis here is to confirm that the subsequent establishment of a competing nearby mall is impractical. These features ensure that the mall operator is able to secure superior returns for its investors.

On the internet, the platform's relationships with both buyer and seller typically exhibit none of this durability. Alternatives for buyers are only a click away, and sophisticated sellers dynamically optimize their ability to reach customers across competing platforms or directly. There are few levers a digital commerce platform can pull to combat this structural reality. Estimates of e-commerce failure rates are as high as 97 percent.

The case of Amazon is complex and the subject of its own chapter. It is worth noting, however, that the most successful operators in the shopping-center sector are wildly more profitable than Amazon's e-commerce operations. The point isn't that you would rather invest in a mall operator than Amazon during a pandemic but simply that off-line business models have surprising relative resilience. It is not a coincidence that, despite the secular trends, right up until the COVID-19 crisis hit, struggling online retailers were increasingly looking to solve their structural woes by opening up mall outlets!

A disproportionate number of the earliest dot-com flameouts-names like Pets.com, Kozmo, Boo.com, and Webvan-were e-commerce companies. These elicit some nostalgia for those of us who lived through the first internet boom but likely cause recurring nightmares for some of the biggest names in venture capital who actually backed them.

The more recent entries into the category have hardly proven much more resilient, although remarkably this has not seemed to significantly dampen the willingness of public and private investors to aggressively finance the category. The "flash sale" craze lasted a few years and briefly produced its own signature unicorn, Gilt Groupe. Online deal marketplace Groupon's 2011 IPO was the largest since Google's in 2004, valuing the company at well over $10 billion. Today, it is a largely forgotten microcap. In 2019, the highest profile crop of e-commerce IPOs, Jumia, Revolve, and Chewy-targeting commerce in Africa, clothing, and pet products, respectively-all soared on their first day of trading but ended the year at a small fraction of the value reflected by that initial euphoria.

Although COVID-19 initially interrupted the IPO dreams of many in the planned e-commerce class of 2020-for instance Poshmark, another fashion retailer, which had previously delayed its IPO-the sector dramatically recovered as investors came to believe in a permanent shift to online buying. Casper, in bedding, tapped the public markets just before the full force of the pandemic was felt and lost 75 percent of its value in the first month-but managed to regain at least some of its IPO price by year end. More dramatically, the once unloved Chewy, described as the Pets.com of the current era, exploded to a market capitalization of over $40 billion. And in September, Poshmark went ahead and filed its IPO paperwork, ultimately becoming one of the earliest hot offerings of 2021. Shifting market sentiment, however, can only mask the fundamental economics of e-commerce for so long.

Digital retail environments provide consumers with bountiful information with respect to both price and product options. But the friend of the buyer is typically the enemy of the seller-as power shifts to consumers and away from producers, exceptional profit opportunities become rare. Online commerce may have been correctly identified as one of the first "killer apps" of the World Wide Web, but overwhelmingly who gets killed are the investors in these businesses.

Of course, all digital commerce businesses are not the same, and these important distinctions are examined more closely later. Some are pure platforms that simply connect buyer and seller, such as eBay. Others, like Casper, actually are the seller themselves and sometimes even the manufacturer. And still others, like Amazon, operate a hybrid model of some sort. And there are large e-commerce sectors, like online travel businesses, that sell services rather than things. Despite their diversity of business models and products, as a group they are surprisingly consistent in at least one regard: disappointing financial performance over time.

During the quarter century since the birth of the commercial internet, dozens of companies in some form of e-commerce have gone public. Almost a quarter have gone bankrupt or delisted. Of those that managed to get acquired before facing that unpleasant prospect, over two thirds sold out for less than their original public offering price. Of the third that remain public companies, over 60 percent have lagged the overall market since their respective IPOs.

All Platforms Exhibit Powerful Network Effects

The imagined talismanic qualities of platform business models are often attributed to the inherent availability of an important economic phenomenon known as "network effects." Sometimes also referred to as the "flywheel effect," it means that every new user increases the value of the network to existing users.

What is so irresistible about network effects is their potential to feed off themselves. There is something compelling about the virtuous circle of steadily increasing advantage reflected in the most successful businesses built on network effects. In theory, every new user increases the relative attractiveness of the business, simultaneously attracting still more new users and making the prospect of successful competitive attack ever more remote.

The logical association between platform businesses and network effects is understandable. Platforms, after all, are generally in the business of managing and facilitating the interaction among network participants. But it is a mistake to conclude that all platforms are powered by strong network effects. In fact, plenty of platform businesses receive little assistance from network effects.

For instance, all ad-supported media businesses, from television broadcasters to internet content providers, serve as platforms to connect advertisers and consumers. The "water cooler" effect may generate some psychic benefit from knowing that others share your interests and advertisers are undoubtedly attracted to a larger audience, but the economics of these businesses are primarily driven by traditional fixed-cost scale. It is the production of hit shows and compelling web content that power these businesses, not network effects either between or among viewers and advertisers. When the content succeeds, the significant fixed infrastructure costs can be spread across the heightened revenue base generated by attracting more viewers and better advertising rates.

Similarly, movie theaters, as noted earlier, represent platforms connecting moviegoers and studios. Their economics, however, have little to do with network effects. Rather, relative profitability has historically been predominantly a function of whether the theaters are regionally clustered in small markets that support few theaters or spread nationally across highly competitive big cities.

Even Zoom, the video communications platform that is perhaps the most iconic success of the pandemic era, is not really a strong network effects business. By the end of 2020, the company was worth over $100 billion and its stock traded at around ten times its 2019 offering price. Zoom is a fabulous product, but its very success in eliminating any friction or complexity in adoption has severely limited how powerful its network effects can be. At this point, multiple competitive products also permit participation by simply clicking on a browser link, so obtaining access to the broadest possible pool of potential network participants is not a differentiator. Without any meaningful costs of switching or real challenges in coordinating among users, the value of any network effects is limited.

It is true that most platform businesses do exhibit network effects. Nonetheless, even where they exist, the nature, extent, and impact of the effects on the attractiveness of the enterprises vary widely. Finally, when, as in the case of Facebook, strong network effects are a crucial feature of a powerful digital platform, there is invariably more to the story. Understanding whether and why to invest in a platform business requires an examination of multiple factors well beyond the presence of network effects.

out of stock INR 1039

1 1

Email ID already exists!

Your Current password is incorrect

Password Updated Successfully

Thanks for your Feedback

- Home

- Business and Management

- The Platform Delusion Who Wins And Who Loses In The Age Of Tech Titans

The Platform Delusion Who Wins And Who Loses In The Age Of Tech Titans

ISBN: 9780593189436

₹1,039

₹1,299 (20% OFF)SIZE GUIDE

Back In Stock Shortly - Fill The Book Request Form

Sold By: Hauz Khas - Aurobindo Market

Details

- ISBN: 9780593189436

- Author: Jonathan A Knee

- Publisher: Penguin Portfolio

- Pages: 384

- Format: Hardback

Book Description

An investment banker and professor explains what really drives success in the tech economy

Many think that they understand the secrets to the success of the biggest tech companies: Facebook, Amazon, Apple, Netflix, and Google. It's the platform economy, or network effects, or some other magical power that makes their ultimate world domination inevitable. Investment banker and professor Jonathan Knee argues that the truth is much more complicated--but entrepreneurs and investors can understand what makes the giants work, and learn the keys to lasting success in the digital economy.

Knee explains what really makes the biggest tech companies work: a surprisingly disparate portfolio of structural advantages buttressed by shrewd acquisitions, strong management, lax regulation, and often, encouraging the myth that they are invincible to discourage competitors. By offering fresh insights into the true sources of strength and very real vulnerabilities of these companies, The Platform Delusion shows how investors, existing businesses, and startups might value them, compete with them, and imitate them.

The Platform Delusion demystifies the success of the biggest digital companies in sectors from retail to media to software to hardware, offering readers what those companies don't want everyone else to know. Knee's insights are invaluable for entrepreneurs and investors in digital businesses seeking to understand what drives resilience and profitability for the long term.

Many think that they understand the secrets to the success of the biggest tech companies: Facebook, Amazon, Apple, Netflix, and Google. It's the platform economy, or network effects, or some other magical power that makes their ultimate world domination inevitable. Investment banker and professor Jonathan Knee argues that the truth is much more complicated--but entrepreneurs and investors can understand what makes the giants work, and learn the keys to lasting success in the digital economy.

Knee explains what really makes the biggest tech companies work: a surprisingly disparate portfolio of structural advantages buttressed by shrewd acquisitions, strong management, lax regulation, and often, encouraging the myth that they are invincible to discourage competitors. By offering fresh insights into the true sources of strength and very real vulnerabilities of these companies, The Platform Delusion shows how investors, existing businesses, and startups might value them, compete with them, and imitate them.

The Platform Delusion demystifies the success of the biggest digital companies in sectors from retail to media to software to hardware, offering readers what those companies don't want everyone else to know. Knee's insights are invaluable for entrepreneurs and investors in digital businesses seeking to understand what drives resilience and profitability for the long term.

Review

“In ‘The Platform Delusion’ Jonathan Knee takes apart the magical aura of one of Silicon Valley's biggest conceptual exports." —The New York Times

"A cogent, arresting argument...Knee’s untangling of the complexities of platforms and their backers is steadily accessible and surprising." —Publishers Weekly

“In pursuit of what makes for a powerful and successful tech company, The Platform Delusion by Jonathan A Knee opts for the broad scope.” —Financial Times

“Every generation flatters itself by thinking it has reinvented the rules of business. Knee’s book is a jolting and often hilarious exposure of our delusions that teaches, once again, that the fundamentals of business may not have changed quite as much as you think they have. Everyone should read this book.” —Tim Wu, author of The Curse of Bigness

“Jonathan Knee mercilessly cuts through the hype and wishful thinking about America’s best-known tech giants to show which really has the coveted competitive advantages likely to reward investors. I can almost guarantee you’ll be as surprised as I was.” —James B. Stewart, Pulitzer Prize–winning author of Disney Wars

“In the worlds of business and investing, the word ‘platform’ has acquired an almost magical significance. Many believe that the term can manifest wealth and prestige for a business. But what does the word really mean? When does it mislead? And how ultimately should we as a society manage the role these businesses play in our life? It’s critical questions like these that Jonathan Knee wrestles with and answers in his important new book, The Platform Delusion.” —Bethany McLean, contributing editor, Vanity Fair, and author of The Smartest Guys in the Room and All the Devils Are Here

“Jonathan Knee has done it again. He identifies where value actually comes from in platform companies. (Spoiler alert: competitive advantage, just like your economics professor taught you.) The book is a must read for students of platform companies and their valuation.” —Glenn Hubbard, Russell L. Carson Professor of Economics and Finance and Dean Emeritus at Columbia Business School

“Essential reading if you really want to understand the age of the digital giants. Jonathan Knee brushes magical thinking and Silicon Valley hype aside and makes a compelling case that while technology changes, the fundamentals of business never do.” —Mark Thompson, chairman of Ancestry and former CEO and president at The New York Times Company

“Jonathan combines the gimlet eye of a banker with the methodical rigor of an academic to produce a deeply thought-out look at the innards of tech industry business models.” —Mark Colodny, co-head of private equity and global head of technology at Warburg Pincus

“The nation’s best business writer.” —Michael Wolff, USA Today

"A cogent, arresting argument...Knee’s untangling of the complexities of platforms and their backers is steadily accessible and surprising." —Publishers Weekly

“In pursuit of what makes for a powerful and successful tech company, The Platform Delusion by Jonathan A Knee opts for the broad scope.” —Financial Times

“Every generation flatters itself by thinking it has reinvented the rules of business. Knee’s book is a jolting and often hilarious exposure of our delusions that teaches, once again, that the fundamentals of business may not have changed quite as much as you think they have. Everyone should read this book.” —Tim Wu, author of The Curse of Bigness

“Jonathan Knee mercilessly cuts through the hype and wishful thinking about America’s best-known tech giants to show which really has the coveted competitive advantages likely to reward investors. I can almost guarantee you’ll be as surprised as I was.” —James B. Stewart, Pulitzer Prize–winning author of Disney Wars

“In the worlds of business and investing, the word ‘platform’ has acquired an almost magical significance. Many believe that the term can manifest wealth and prestige for a business. But what does the word really mean? When does it mislead? And how ultimately should we as a society manage the role these businesses play in our life? It’s critical questions like these that Jonathan Knee wrestles with and answers in his important new book, The Platform Delusion.” —Bethany McLean, contributing editor, Vanity Fair, and author of The Smartest Guys in the Room and All the Devils Are Here

“Jonathan Knee has done it again. He identifies where value actually comes from in platform companies. (Spoiler alert: competitive advantage, just like your economics professor taught you.) The book is a must read for students of platform companies and their valuation.” —Glenn Hubbard, Russell L. Carson Professor of Economics and Finance and Dean Emeritus at Columbia Business School

“Essential reading if you really want to understand the age of the digital giants. Jonathan Knee brushes magical thinking and Silicon Valley hype aside and makes a compelling case that while technology changes, the fundamentals of business never do.” —Mark Thompson, chairman of Ancestry and former CEO and president at The New York Times Company

“Jonathan combines the gimlet eye of a banker with the methodical rigor of an academic to produce a deeply thought-out look at the innards of tech industry business models.” —Mark Colodny, co-head of private equity and global head of technology at Warburg Pincus

“The nation’s best business writer.” —Michael Wolff, USA Today

About the Author

Jonathan A. Knee is the author of The Accidental Investment Banker: Inside the Decade That Transformed Wall Street and the co-author of The Curse of the Mogul. Professor Knee’s writing has appeared in The Atlantic, the Wall Street Journal, the New York Times and elsewhere. Knee is a Professor of Finance and Economics at the Columbia Graduate School of Business, and has previously taught at Northwestern University. He is also a Senior Advisor at Evercore Partners, a boutique investment banking firm. Before joining Evercore, he was a managing director and co-head of Morgan Stanley's Media Group.

Excerpt. © Reprinted by permission. All rights reserved.

The Four Pillars of the Platform Delusion

The Platform Delusion most often manifests itself subtly, as an unspoken assumption underlying confident assertions regarding the direction of the economy or the imagined invincibility of a particular enterprise. Regardless of exact terminology-"the platform economy," "the platform revolution," and "the platform effect" have emerged as common terms-the central fallacy relies on a consistent mythology and the confident expectation of world domination by a select few megaplatforms. This conventional wisdom rests overwhelmingly on four core pillars of belief.

Each of these is demonstrably false.

The Core Tenets of the Platform Delusion

1. Platforms Are a Revolutionary New Business Model.

2. Digital Platforms Are Structurally Superior to Analog Platforms.

3. All Platforms Exhibit Powerful Network Effects.

4. Network Effects Lead Inexorably to Winner-Take-All Markets.

Platforms Are a Revolutionary New Business Model

It is true that business school professors only started writing in earnest about platform business models after 2000. But it is a terrible mistake to date a social or economic phenomenon only from the moment that academics decided to take note. Well before the internet was even conceived, much less commercialized, the average consumer interacted with platform businesses on a daily basis.

The definition of a "platform" business is straightforward. Although they take many forms, what platforms have in common is that their core value proposition lies in the connections they enable and enhance. "They bring together individuals and organizations," a recent review of platform businesses and research summarized, "so they can innovate or interact in ways not otherwise possible."

The persistent confusion regarding what constitutes a platform business, despite the relatively simple definition, is mostly due to unhelpful market incentives. As is often the case, when a moniker emerges that affords a premium valuation, all manner of enterprises twist themselves in knots to claim a credible association with the term. So, for instance, it should not be surprising that a fast-food salad chain would promote itself as a "food platform." The company, Sweetgreen, has even attracted a distinguished Harvard Business School professor to the board to lend legitimacy to the pitch.

That said, the diversity of connections made possible by the internet has spawned a mind-boggling array of legitimate platform businesses, often with very different business models. Sometimes the platform's source of value comes from a financial transaction by matching a buyer and a seller in a marketplace, sometimes it comes from facilitating innovation through the addition of functionality and content to a shared environment like a gaming platform, and sometimes it comes just from the interaction itself, as in the case of a social network. This explosion of new platforms has led to a strange amnesia regarding the ubiquity of platform businesses long before the dawn of the digital age.

Some of the platform businesses that predated the internet were primarily electronic, like credit cards. Introduced by Diners Club in 1950 and pervasive by the 1970s after the establishment of American Express, Visa and Mastercard, credit cards serve as a platform on which merchants and customers can transact. By the end of 2020, Visa was worth almost half a trillion dollars, with Mastercard not far behind.

Other long-established platform businesses are physical, like the iconic malls that connect retailers with shoppers throughout the country. The Southdale Center in Edina, Minnesota, generally identified as the first modern shopping mall, opened in 1956 and still operates today. Movie theaters similarly are platform businesses. Exhibitors negotiate with studios to get the best films on the best terms and market the experience to local moviegoers. The ability to get the best films is in part a function of the credibility of their claim to be able to attract the biggest possible audience, and their ability to fill the theater will be in part a function of the films they secure.

This chicken-and-egg dynamic inherent in platform businesses has not fundamentally changed with the internet. Operators face the same basic business issues-who and how to charge, encouraging platform loyalty, and "traffic" monetization strategies, for instance-in seeking to build and maintain successful multisided platforms.

What is surprising is that it took so long for it to occur to anyone to study the structure and economics of platform businesses. Nobel Prize-winning economist Jean Tirole is the coauthor of an article from 2003 which, if not the absolute first to examine the phenomenon, is most widely cited and appears to have launched the avalanche of research and publications that have followed. Interestingly, given the supposed connection between the "discovery" of platforms and the availability of the internet, the seminal article was not published in a US journal despite that the most notable digital platforms of scale were developed here.

The authors of this groundbreaking article seem slightly bemused that the topic had previously attracted such "scant attention" despite decades of research focused on network economics and chicken-and-egg problems. What's more, although some internet businesses are discussed, most of the examples used in their analysis (including video games, credit cards, and operating systems) substantially predate the internet and in many cases (like discount coupon books, shopping malls, and real estate brokers) are decidedly low-tech. This has not dissuaded the media or other academics from characterizing Tiroles' intellectual contribution as somehow applying uniquely or differently to "Internet-era companies."

The conviction that platforms are something new and different seems only to have intensified in recent years. The term "platform" has entered the vernacular with a vengeance, as a review of search terms over the past decade reveals. Whether this coincides with a corresponding increase in understanding of the distinguishing characteristics of platform businesses seems questionable at best.

Digital Platforms Are Structurally Superior to Analog Platforms

Even if platforms are not a new concept, the internet has vastly expanded the range, scope, and size of potential platform businesses. In many cases, these new digital models have proved devastating to long-established franchises. But bigger is not always better, and the ability to upend does not always signal a capability of creating lasting value.

The undeniable, sometimes shocking strength of the handful of the largest digital platforms established in recent decades-Google and Facebook in particular-has led to a broader assumption that digital platforms are consistently better businesses than the analog equivalents. This is an assumption that does not bear up to scrutiny. It has also proven costly to many investors.

A comparison of the key business characteristics of one familiar analog platform and its digital equivalent demonstrates the depth of this fallacy. Shopping malls and their digital counterpart, e-commerce websites, represent the simplest of two-sided platforms connecting sellers and buyers.

Traditional malls had two major benefits: their vendors were committed to long-term leases and their shoppers' next best option was many miles away. Before committing to construction, a mall developer will typically secure a handful of anchor tenants and often obtain not only an extended commitment, but a promise not to open any other stores within a certain distance of the mall. The original site-selection process incorporates considerations of demographics, shopping alternatives, and land cost and availability. A key analysis here is to confirm that the subsequent establishment of a competing nearby mall is impractical. These features ensure that the mall operator is able to secure superior returns for its investors.

On the internet, the platform's relationships with both buyer and seller typically exhibit none of this durability. Alternatives for buyers are only a click away, and sophisticated sellers dynamically optimize their ability to reach customers across competing platforms or directly. There are few levers a digital commerce platform can pull to combat this structural reality. Estimates of e-commerce failure rates are as high as 97 percent.

The case of Amazon is complex and the subject of its own chapter. It is worth noting, however, that the most successful operators in the shopping-center sector are wildly more profitable than Amazon's e-commerce operations. The point isn't that you would rather invest in a mall operator than Amazon during a pandemic but simply that off-line business models have surprising relative resilience. It is not a coincidence that, despite the secular trends, right up until the COVID-19 crisis hit, struggling online retailers were increasingly looking to solve their structural woes by opening up mall outlets!

A disproportionate number of the earliest dot-com flameouts-names like Pets.com, Kozmo, Boo.com, and Webvan-were e-commerce companies. These elicit some nostalgia for those of us who lived through the first internet boom but likely cause recurring nightmares for some of the biggest names in venture capital who actually backed them.

The more recent entries into the category have hardly proven much more resilient, although remarkably this has not seemed to significantly dampen the willingness of public and private investors to aggressively finance the category. The "flash sale" craze lasted a few years and briefly produced its own signature unicorn, Gilt Groupe. Online deal marketplace Groupon's 2011 IPO was the largest since Google's in 2004, valuing the company at well over $10 billion. Today, it is a largely forgotten microcap. In 2019, the highest profile crop of e-commerce IPOs, Jumia, Revolve, and Chewy-targeting commerce in Africa, clothing, and pet products, respectively-all soared on their first day of trading but ended the year at a small fraction of the value reflected by that initial euphoria.

Although COVID-19 initially interrupted the IPO dreams of many in the planned e-commerce class of 2020-for instance Poshmark, another fashion retailer, which had previously delayed its IPO-the sector dramatically recovered as investors came to believe in a permanent shift to online buying. Casper, in bedding, tapped the public markets just before the full force of the pandemic was felt and lost 75 percent of its value in the first month-but managed to regain at least some of its IPO price by year end. More dramatically, the once unloved Chewy, described as the Pets.com of the current era, exploded to a market capitalization of over $40 billion. And in September, Poshmark went ahead and filed its IPO paperwork, ultimately becoming one of the earliest hot offerings of 2021. Shifting market sentiment, however, can only mask the fundamental economics of e-commerce for so long.

Digital retail environments provide consumers with bountiful information with respect to both price and product options. But the friend of the buyer is typically the enemy of the seller-as power shifts to consumers and away from producers, exceptional profit opportunities become rare. Online commerce may have been correctly identified as one of the first "killer apps" of the World Wide Web, but overwhelmingly who gets killed are the investors in these businesses.

Of course, all digital commerce businesses are not the same, and these important distinctions are examined more closely later. Some are pure platforms that simply connect buyer and seller, such as eBay. Others, like Casper, actually are the seller themselves and sometimes even the manufacturer. And still others, like Amazon, operate a hybrid model of some sort. And there are large e-commerce sectors, like online travel businesses, that sell services rather than things. Despite their diversity of business models and products, as a group they are surprisingly consistent in at least one regard: disappointing financial performance over time.

During the quarter century since the birth of the commercial internet, dozens of companies in some form of e-commerce have gone public. Almost a quarter have gone bankrupt or delisted. Of those that managed to get acquired before facing that unpleasant prospect, over two thirds sold out for less than their original public offering price. Of the third that remain public companies, over 60 percent have lagged the overall market since their respective IPOs.

All Platforms Exhibit Powerful Network Effects

The imagined talismanic qualities of platform business models are often attributed to the inherent availability of an important economic phenomenon known as "network effects." Sometimes also referred to as the "flywheel effect," it means that every new user increases the value of the network to existing users.

What is so irresistible about network effects is their potential to feed off themselves. There is something compelling about the virtuous circle of steadily increasing advantage reflected in the most successful businesses built on network effects. In theory, every new user increases the relative attractiveness of the business, simultaneously attracting still more new users and making the prospect of successful competitive attack ever more remote.

The logical association between platform businesses and network effects is understandable. Platforms, after all, are generally in the business of managing and facilitating the interaction among network participants. But it is a mistake to conclude that all platforms are powered by strong network effects. In fact, plenty of platform businesses receive little assistance from network effects.

For instance, all ad-supported media businesses, from television broadcasters to internet content providers, serve as platforms to connect advertisers and consumers. The "water cooler" effect may generate some psychic benefit from knowing that others share your interests and advertisers are undoubtedly attracted to a larger audience, but the economics of these businesses are primarily driven by traditional fixed-cost scale. It is the production of hit shows and compelling web content that power these businesses, not network effects either between or among viewers and advertisers. When the content succeeds, the significant fixed infrastructure costs can be spread across the heightened revenue base generated by attracting more viewers and better advertising rates.

Similarly, movie theaters, as noted earlier, represent platforms connecting moviegoers and studios. Their economics, however, have little to do with network effects. Rather, relative profitability has historically been predominantly a function of whether the theaters are regionally clustered in small markets that support few theaters or spread nationally across highly competitive big cities.

Even Zoom, the video communications platform that is perhaps the most iconic success of the pandemic era, is not really a strong network effects business. By the end of 2020, the company was worth over $100 billion and its stock traded at around ten times its 2019 offering price. Zoom is a fabulous product, but its very success in eliminating any friction or complexity in adoption has severely limited how powerful its network effects can be. At this point, multiple competitive products also permit participation by simply clicking on a browser link, so obtaining access to the broadest possible pool of potential network participants is not a differentiator. Without any meaningful costs of switching or real challenges in coordinating among users, the value of any network effects is limited.

It is true that most platform businesses do exhibit network effects. Nonetheless, even where they exist, the nature, extent, and impact of the effects on the attractiveness of the enterprises vary widely. Finally, when, as in the case of Facebook, strong network effects are a crucial feature of a powerful digital platform, there is invariably more to the story. Understanding whether and why to invest in a platform business requires an examination of multiple factors well beyond the presence of network effects.

The Platform Delusion most often manifests itself subtly, as an unspoken assumption underlying confident assertions regarding the direction of the economy or the imagined invincibility of a particular enterprise. Regardless of exact terminology-"the platform economy," "the platform revolution," and "the platform effect" have emerged as common terms-the central fallacy relies on a consistent mythology and the confident expectation of world domination by a select few megaplatforms. This conventional wisdom rests overwhelmingly on four core pillars of belief.

Each of these is demonstrably false.

The Core Tenets of the Platform Delusion

1. Platforms Are a Revolutionary New Business Model.

2. Digital Platforms Are Structurally Superior to Analog Platforms.

3. All Platforms Exhibit Powerful Network Effects.

4. Network Effects Lead Inexorably to Winner-Take-All Markets.

Platforms Are a Revolutionary New Business Model

It is true that business school professors only started writing in earnest about platform business models after 2000. But it is a terrible mistake to date a social or economic phenomenon only from the moment that academics decided to take note. Well before the internet was even conceived, much less commercialized, the average consumer interacted with platform businesses on a daily basis.

The definition of a "platform" business is straightforward. Although they take many forms, what platforms have in common is that their core value proposition lies in the connections they enable and enhance. "They bring together individuals and organizations," a recent review of platform businesses and research summarized, "so they can innovate or interact in ways not otherwise possible."

The persistent confusion regarding what constitutes a platform business, despite the relatively simple definition, is mostly due to unhelpful market incentives. As is often the case, when a moniker emerges that affords a premium valuation, all manner of enterprises twist themselves in knots to claim a credible association with the term. So, for instance, it should not be surprising that a fast-food salad chain would promote itself as a "food platform." The company, Sweetgreen, has even attracted a distinguished Harvard Business School professor to the board to lend legitimacy to the pitch.

That said, the diversity of connections made possible by the internet has spawned a mind-boggling array of legitimate platform businesses, often with very different business models. Sometimes the platform's source of value comes from a financial transaction by matching a buyer and a seller in a marketplace, sometimes it comes from facilitating innovation through the addition of functionality and content to a shared environment like a gaming platform, and sometimes it comes just from the interaction itself, as in the case of a social network. This explosion of new platforms has led to a strange amnesia regarding the ubiquity of platform businesses long before the dawn of the digital age.

Some of the platform businesses that predated the internet were primarily electronic, like credit cards. Introduced by Diners Club in 1950 and pervasive by the 1970s after the establishment of American Express, Visa and Mastercard, credit cards serve as a platform on which merchants and customers can transact. By the end of 2020, Visa was worth almost half a trillion dollars, with Mastercard not far behind.

Other long-established platform businesses are physical, like the iconic malls that connect retailers with shoppers throughout the country. The Southdale Center in Edina, Minnesota, generally identified as the first modern shopping mall, opened in 1956 and still operates today. Movie theaters similarly are platform businesses. Exhibitors negotiate with studios to get the best films on the best terms and market the experience to local moviegoers. The ability to get the best films is in part a function of the credibility of their claim to be able to attract the biggest possible audience, and their ability to fill the theater will be in part a function of the films they secure.

This chicken-and-egg dynamic inherent in platform businesses has not fundamentally changed with the internet. Operators face the same basic business issues-who and how to charge, encouraging platform loyalty, and "traffic" monetization strategies, for instance-in seeking to build and maintain successful multisided platforms.

What is surprising is that it took so long for it to occur to anyone to study the structure and economics of platform businesses. Nobel Prize-winning economist Jean Tirole is the coauthor of an article from 2003 which, if not the absolute first to examine the phenomenon, is most widely cited and appears to have launched the avalanche of research and publications that have followed. Interestingly, given the supposed connection between the "discovery" of platforms and the availability of the internet, the seminal article was not published in a US journal despite that the most notable digital platforms of scale were developed here.

The authors of this groundbreaking article seem slightly bemused that the topic had previously attracted such "scant attention" despite decades of research focused on network economics and chicken-and-egg problems. What's more, although some internet businesses are discussed, most of the examples used in their analysis (including video games, credit cards, and operating systems) substantially predate the internet and in many cases (like discount coupon books, shopping malls, and real estate brokers) are decidedly low-tech. This has not dissuaded the media or other academics from characterizing Tiroles' intellectual contribution as somehow applying uniquely or differently to "Internet-era companies."

The conviction that platforms are something new and different seems only to have intensified in recent years. The term "platform" has entered the vernacular with a vengeance, as a review of search terms over the past decade reveals. Whether this coincides with a corresponding increase in understanding of the distinguishing characteristics of platform businesses seems questionable at best.

Digital Platforms Are Structurally Superior to Analog Platforms

Even if platforms are not a new concept, the internet has vastly expanded the range, scope, and size of potential platform businesses. In many cases, these new digital models have proved devastating to long-established franchises. But bigger is not always better, and the ability to upend does not always signal a capability of creating lasting value.

The undeniable, sometimes shocking strength of the handful of the largest digital platforms established in recent decades-Google and Facebook in particular-has led to a broader assumption that digital platforms are consistently better businesses than the analog equivalents. This is an assumption that does not bear up to scrutiny. It has also proven costly to many investors.

A comparison of the key business characteristics of one familiar analog platform and its digital equivalent demonstrates the depth of this fallacy. Shopping malls and their digital counterpart, e-commerce websites, represent the simplest of two-sided platforms connecting sellers and buyers.

Traditional malls had two major benefits: their vendors were committed to long-term leases and their shoppers' next best option was many miles away. Before committing to construction, a mall developer will typically secure a handful of anchor tenants and often obtain not only an extended commitment, but a promise not to open any other stores within a certain distance of the mall. The original site-selection process incorporates considerations of demographics, shopping alternatives, and land cost and availability. A key analysis here is to confirm that the subsequent establishment of a competing nearby mall is impractical. These features ensure that the mall operator is able to secure superior returns for its investors.

On the internet, the platform's relationships with both buyer and seller typically exhibit none of this durability. Alternatives for buyers are only a click away, and sophisticated sellers dynamically optimize their ability to reach customers across competing platforms or directly. There are few levers a digital commerce platform can pull to combat this structural reality. Estimates of e-commerce failure rates are as high as 97 percent.

The case of Amazon is complex and the subject of its own chapter. It is worth noting, however, that the most successful operators in the shopping-center sector are wildly more profitable than Amazon's e-commerce operations. The point isn't that you would rather invest in a mall operator than Amazon during a pandemic but simply that off-line business models have surprising relative resilience. It is not a coincidence that, despite the secular trends, right up until the COVID-19 crisis hit, struggling online retailers were increasingly looking to solve their structural woes by opening up mall outlets!

A disproportionate number of the earliest dot-com flameouts-names like Pets.com, Kozmo, Boo.com, and Webvan-were e-commerce companies. These elicit some nostalgia for those of us who lived through the first internet boom but likely cause recurring nightmares for some of the biggest names in venture capital who actually backed them.

The more recent entries into the category have hardly proven much more resilient, although remarkably this has not seemed to significantly dampen the willingness of public and private investors to aggressively finance the category. The "flash sale" craze lasted a few years and briefly produced its own signature unicorn, Gilt Groupe. Online deal marketplace Groupon's 2011 IPO was the largest since Google's in 2004, valuing the company at well over $10 billion. Today, it is a largely forgotten microcap. In 2019, the highest profile crop of e-commerce IPOs, Jumia, Revolve, and Chewy-targeting commerce in Africa, clothing, and pet products, respectively-all soared on their first day of trading but ended the year at a small fraction of the value reflected by that initial euphoria.